The ‘fiscal cliff’ refers to the cut in government stimulus payments that are due to occur at the end of March this year. Buyers may have convinced themselves that the possible distress this may cause to home owners and small business owners and/or parts of pandemic affected sectors of the economy will flow into opportunities in the property market.

Here are three graphs why the fiscal cliff won’t happen.

1. Fundamentals

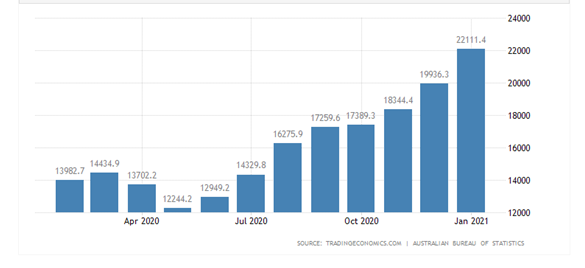

Inflated asset prices has always been a symptom of low interest rates and probably its biggest indicator. Low interest rates fuel credit growth increasing the number and the value of these loans that are taken out. The Australian Bureau of Statistics lagging data shows that the value of home loans increased 10.9% from Dec 2020 to Jan 2021 to $22.1 billion after an 8.7% gain in December 2020. What will be consistent in the data is that loan value increases will be matched with house price increases. It’s the loans that pump the prices not the deposits.

2. Loan Deferrals

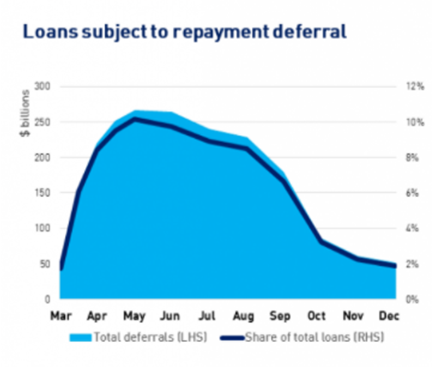

Banks stepped in early to provide a loan deferral facility for their customers who were affected by the pandemic. This facility allowed loan repayments to be deferred for a six month period then an additional four months.

APRA research shows that the amount of loan deferrals peaked in May 2020 at 10% deferred of total loans. The amount of deferred loans has dropped significantly since then. Now only representing 1.9% of total loans. It is far more lucrative for banks to keep borrowers on their books by allowing them to add their interest to the principal through loan deferrals.

If banks sell distressed borrowers homes. There would be little to gain other than the recuperation of losses in a robust market. They will have one less borrower and a public backlash over cashing in on misfortune. It’s far better to be the hero while the funding from the RBA is cheap and help a borrower struck down on hard times believing that they will one day be able to start repaying their mortgage in the future.

3. Nature of tail-end risks and consequences

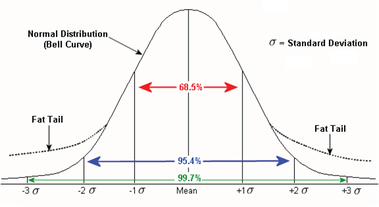

A tail end risk refers to the end sections of the bell-shaped distribution curve which measures the statistical probability of an unlikely event in which an asset price will move in three standard deviations from the current price. In layman terms, a tail-end risk is the possibility of a unlikely event to occur and cause a very large loss.

Every single recession in the last one hundred years has been caused by the consequences of an unlikely and unforeseen event that had occurred. We can see it in the COVID-19 pandemic, Global Financial Crisis, 9/11 just to name the last three. What does this say about significant negative price changes in history?

You can not predict it.

The biggest changes in prices are caused by these very unlikely events occurring. The average consequences of risk are what we see day-to-day in the newspapers.

The ‘fiscal cliff’ has been touted to be a significant risk to the Australian economy. If so, we were able to predict it, adapt to it, and work our way around it.

If anything, it would likely result in an average consequence to the economy which we will read about in the newspapers.

Alexander Gibson