The residential housing market value in Australia has reached an estimated $9.1 trillion, gaining $1 trillion in just 5 months, but where are these figures coming from? Property prices?

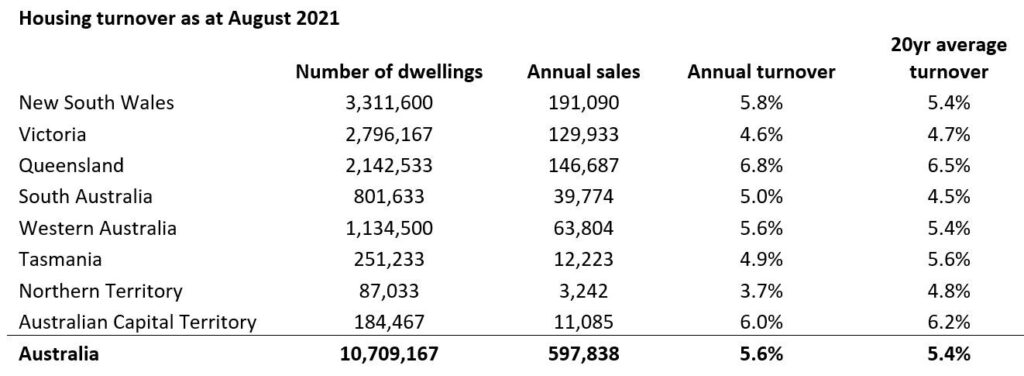

From the year ending to August 2021 there were almost 598,000 house and unit sales across Australia according to Corelogic. The volume of sales throughout the year influences property prices

As you can see from the information, New South Wales leads the country in annual sales. A key statistic to derive is the percentage of annual sales turnover in Australia being 5.6% with a 20-year term average of 5.4%. This means that the property price results of just 5.6% of properties are determining the value of the other 94.6% of properties. The market conditions that are influencing the property prices of just 5.4% of properties dictate the perceived value of the entire residential market.

Property as an asset class

Unlike other markets such as shares or bonds, no two properties are the same. The real estate market is illiquid, has low volatility, low turnover. Generally, ownership is isolated to one property per household. There is an emotional connection between the owner and the asset. Yet the valuation and the way it is treated as an asset type that is liquid, highly volatile, and high turnover has distorted the perception of the residential market.

If you buy a single share of CBA it is the exact same as the other 1.69 billion shares. Then I sell it tomorrow but then decide to buy it back the day after, It will be exactly like the share I previously own. If I buy shares, I pay a small flat brokerage fee, whether I buy 1 or 1,000. I decide to sell my shares it can happen in a split second. If I own shares, I cannot live in those shares. I can’t store all my belongings in those shares. If I own those shares for 20 years, I will not reflect on the memories of receiving dividend payments. The asset types are completely different.

The reality of buying and selling property

The market conditions have skewed perceptions of the value of their own assets. Like a ratchet, these perceptions only really move one way. Once a property in your street sells for a great price, inevitably you would not sell for anything less even if this result was an outlier, and why should you?

If you own your home outright or comfortably pay your mortgage month after month. Why would you settle for less? There is no external factor placing pressure to sell. In fact, I believe the pressure not to sell is much higher which helps reinforces a higher price that is required to convince you to move. If you sell your home you would have to undertake the endeavour to find another home. Without savings, you are already looking for properties that are below what you sold your property for as you need to factor in stamp duty. For a property that sold for $3 million, it carries a stamp duty of circa $150,000. You would have to start looking for a property at $2,850,000. Why would you sell only to settle for a property price for something that is less?

Of course, you could always take out a loan. However, now you’ll find yourself in a situation where before you were debt-free and king or queen of your castle to now. Competing for homes with other buyers and taking on another mortgage. In order to afford the property upgrade that you are now re-thinking that you needed. Now do people who own shares or bonds have the same feelings and problems when selling their assets? I doubt it.

The media and people’s expectations on property prices

The media perpetuates market conditions through its narrative of an unstoppable market with strong property prices forever. As no one will read, or click on a newspaper with the headline “Sydney property sells for the price that everyone expected.” At the same time, no one really wants to read that the market dropped and that their home is worth less than what it was worth one year ago. As they would be more reluctant to spend money if they feel less wealthy. Considering that on average property accounts for 52.9% of Australians’ wealth. The ebbs and flows in the property market really impact the buying and spending habits of Australians and the economy as a whole. This concept is known as the wealth effect.

To conclude, a $9 trillion valuation of the residential market is just a figure based on the market conditions of the previous 12 months. A blanket growth rate that is applied to every home in Australia. Whether it’s a waterfront mansion in Point Piper, or a beach shack in Broome. Both are being treated the same as other asset classes that do not share the same characteristics. In the year ending August 2021, 598,000 (5.6%) property prices each unique to one another are determining the value of 10.7 million households.

Alexander Gibson